1. Lagrange dual problem: standard form, Lagrange dual function, and dual problem

First, we consider an optimization problem in the standard form:

minimize

subject to i = 1, …, m

i = 1, …, p

with variable , domain

is nonempty. The optimal value is

.

The idea of lagrangian duality is to take the constraints into account by augmenting the objective function with a weighted sum of the constraint functions.

Lagrangian as:

with ,

as the Lagrange multiplier associated with the

inequality constraint

and

as the Lagrange multiplier associated with the

equality constraint

.

Lagrange dual function is the minimum value of the Lagrangian.

For

If , then

.

Proof:

If is feasible and

, then

minimizing over all feasible gives

The dual problem: what is the best lower bound that can be obtained from the Lagrange dual function?

maximize

subject to

Optimal value is denoted as

2. Weak and strong duality

If , this property is called weak duality. The weak duality inequality holds when

and

are infinite while If the equality

holds then we say that strong duality holds.

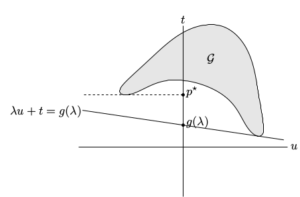

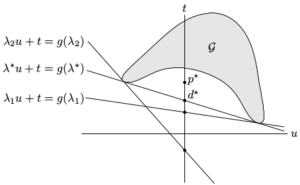

3. Geometric interpretation of dual function and lower bound

For a problem with one (inequality) constraint. Given λ, we minimize over

. This yields a supporting hyperplane with slope −λ. The intersection of this hyperplane with the u = 0 axis gives g(λ). Supporting hyperplanes corresponding to three dual feasible values of λ, i.e, optimum

,

, and

. As shown in the figures, strong duality does not hold so the optimal duality gap

is positive.

4. Price or profit interpretation

Suppose the variable x denotes how an enterprise operates and denotes the cost of operating at x, then

is the profit made at the operating condition x.

Each constraint represents some limit on resources (e.g., warehouse space, labor) or a regulatory limit (e.g., environmental). The operating condition that maximizes profit while respecting the limits can be found by solving the problem:

minimize

subject to , i = 1, …, m.

The resulting optimal profit is resulting optimal profit is

.

Now imagine a second scenario in which the limits can be violated, by paying an additional cost which is linear in the amount of violation, measured by . Enterprise for the

limit or constraint is

. Payments are also made to the firm for constraints that are not tight; if

represents a payment to the firm.

The coefficient has the interpretation of the price for violating

; its units are dollars per unit violation. For the same price the enterprise can sell any ‘unused’ portion of the

constraint. We assume

, i.e., the firm must pay for violations.

Reference

Boyd and Vandenberghe, Chapter 5–5.5 https://web.stanford.edu/~boyd/cvxbook/bv_cvxbook.pdf